Workflow-based Process Automation for Banks and Financial Institutions

Workflow-based process automation can be the way to tackle and solve a variety of challenges and pain points, banks are facing in today’s complex business environment. If some of these are familiar to you, jump right in to our services portfolio.

Browse solutions for:

- Rising process complexity

- High shares of manual processes

- Misalignment between business and IT functions

- Insufficient connectivity between internal and external systems

- Limited transparency and operational control

- Regulatory compliance requirements not met

Core Process Automation Services

1. End-to-End Process Orchestration

Solution for pain point: rising process complexity

If your organization struggles with processes that span multiple departments and IT systems, end-to-end orchestration might be what you need. Looking to eliminate silos in your operations? Process orchestration can connect your people, systems, and devices.

Examplary use case: A mortgage application process could seamlessly connect customer application, credit checks, risk assessment, underwriting, documentation, compliance verification, and approval – ensuring each department knows exactly when to perform their tasks and providing visibility throughout the entire process.

2. Decision Automation Implementation

Solution for pain point: high shares of manual processes

If your staff spends too much time on routine decisions, decision automation might free up valuable resources. Looking to ensure consistency in your business rules? Decision modeling and automation could help. Our business-oriented approach empowers specialists departments to make changes by deploying Decision Models and Notation (DMN), without requiring extensive technical expertise. We believe in cooperative development of the code, bringing together business and IT perspectives for solutions that truly match your requirements.

Examplary use case: An example of decision automation would be for a credit limit increase decision. This decision could be automated to evaluate customer payment history, account age, credit score, and spending patterns to instantly approve increases within predefined parameters, leaving only exceptions for manual review and significantly accelerating response times.

3. BPMN Implementation

Solution for pain point: Misalignment between business and IT functions

If you’re seeking clarity in your business processes, BPMN 2.0 (Business Process Model and Notation) offers a standardized approach to process mapping that bridges the gap between business and IT. BANCOS can help bring standardization and efficiency to your process execution and documentation.

Examplary use case: A customer onboarding process for credit cards could be visualized to show exactly how KYC verification, account setup, card issuance, and welcome communications flow together, ensuring regulatory compliance and consistent customer experience across all channels.

4. REST API Development

Solution for pain point: Insufficient connectivity between internal and external systems

Are you expanding your digital sales channels or internal IT systems? API development could connect your core systems to new interfaces. If you’re looking to enhance your mobile banking capabilities, custom APIs might enable innovative features.

Examplary use case: Comparison platforms are key sales channels, especially in the lending business. With dedicated APIs, customer inquiries and data can be transferred from there to the internal banking systems to enable a smooth and seamless onboarding process.

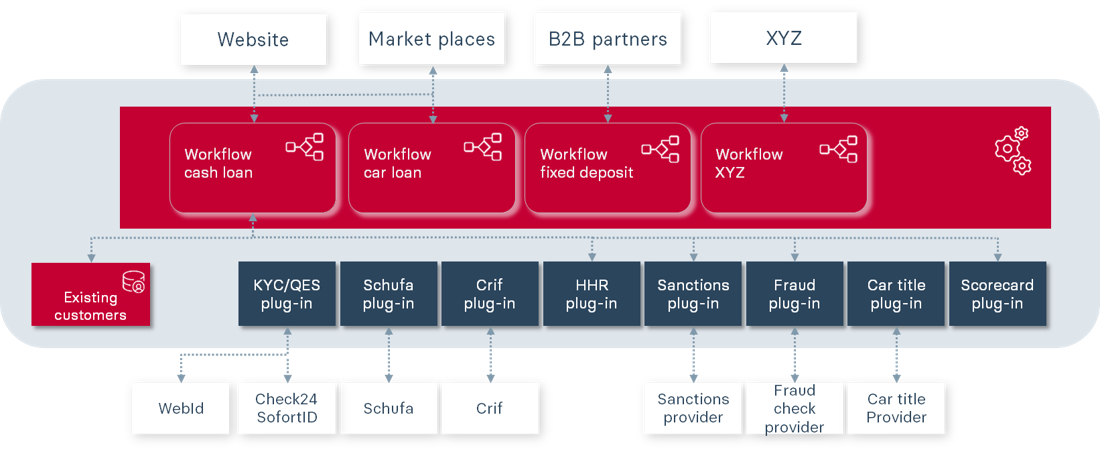

BANCOS Plugin Repository

Our plugin repository contains for example ready-to-use modules for Digital Account Checks (DAC), Know Your Customer (KYC) verification, Qualified Electronic Signatures (QES), and credit bureau integrations. Each plugin is designed for seamless integration with your existing systems, significantly reducing development time while ensuring full compliance with regulatory requirements.

Add-on Services with process automation

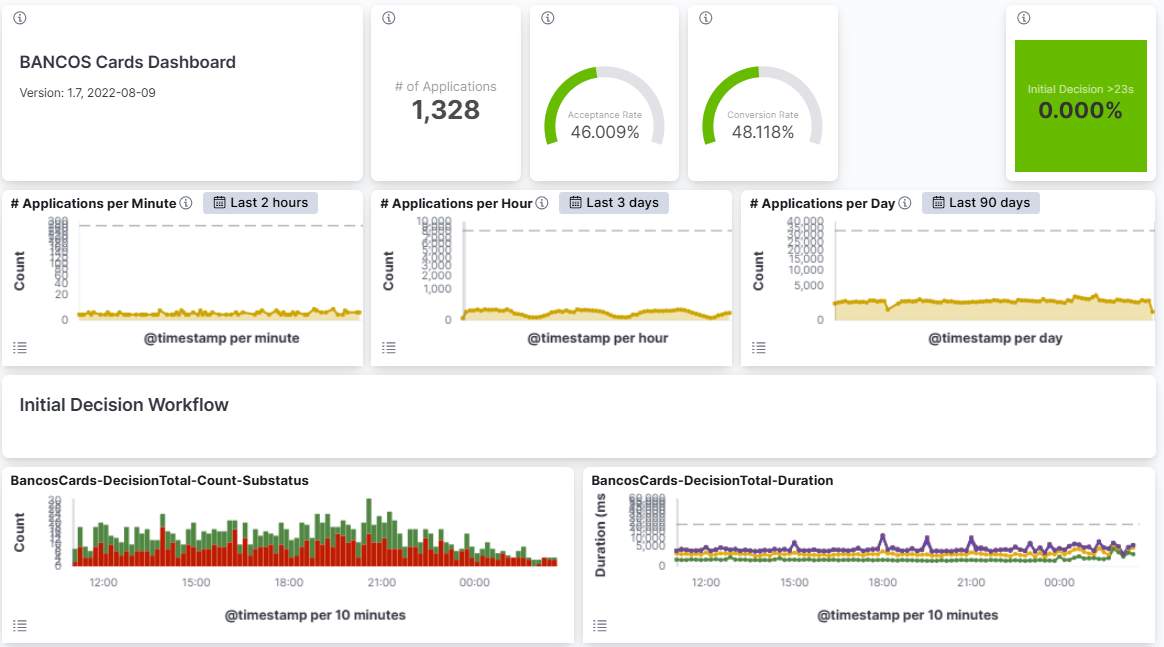

1. Process Monitoring, Visualization and Optimization

Solution for pain point: limited transparency and operational control

Are you looking for comprehensive visibility into your business processes? BANCOS monitoring and visualization solutions provide real-time insights that transform operational data into strategic advantages. If you can’t identify where bottlenecks occur or need better executive visibility into operations, our integrated monitoring and dashboard tools offer the transparency you need.

Our executive dashboards for operations like corporate loan applications visualize applications at each stage. This enables data-driven decisions about resource allocation and process improvements, turning operational metrics into strategic advantages that impact your bottom line.

2. Compliance and SLA Management

Solution for pain point: regulatory compliance requirements not met

Are regulatory deadlines keeping you up at night? BANCOS compliance and SLA management solutions provide peace of mind for financial institutions facing stringent regulatory requirements and obligations. If you’re struggling to meet compliance standards or have received regulatory findings, our automation solutions can transform your approach to regulatory management.

Our solutions in the form of a comprehensive regulatory reporting workflow provide complete auditability. They enable you to transform regulatory findings into opportunities for operational excellence, turning a potential liability into a competitive advantage while significantly reducing the risk of regulatory penalties.

Frequently Asked Questions

How long might implementation take for a typical financial institution?

Implementation timelines vary based on complexity, but most projects can be completed in phases, with initial results visible within a few months.

What’s involved in integrating workflow automation with existing systems?

Integration typically involves API connections, data mapping, and sometimes custom connectors for legacy systems. Our team assesses your current architecture to determine the best approach.

How do companies typically measure ROI from workflow automation projects?

ROI is often measured through time savings, error reduction, improved compliance, faster processing times, and enhanced customer satisfaction scores.

What level of customization is possible for financial services workflows?

Workflows can be highly customized to your specific business processes, regulatory requirements, and customer experience goals, while still leveraging industry best practices.

Meet the team

If you’re looking for expertise in financial services and banking, advanced technological capabilities, and a proven implementation methodology, BANCOS is the partner you need for your project in process automation.

|

|

| Marco Brüders Product Lead Process Automation |

Stephan Heckmaier VP Business Development |

Your benefits in process automation with BANCOS

Deep Industry Expertise

30+ years of experience in banking and financial processes

Specialized Development Team

Focused exclusively on workflow automation for banks and financial services

Proven Track Record

Successful implementations across diverse financial institutions

Rigorous Quality Assurance

Team specific comprehensive testing and security protocols

Regulatory Compliance Focus

Built-in compliance to reduce regulatory risk

Dedicated Support

Ongoing partnership beyond initial launch

Our clients include: